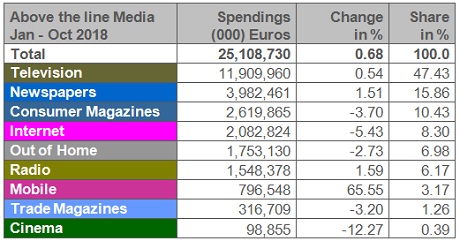

German companies continued to increase their spendings in the above the line media cautiously by only 0.7% to a total of 25.11 billion Euros from January – October 2018 compared to the same period last year.

Mobile remains the strongest growing medium with +65.6% (797 million Euros). TV continues to be the leading medium with 11,91 billion Euros spent (+0.5%). Consumer magazines and trade magazines see losses (-3.7% resp. -3.2%), newspapers have experienced a plus of 1.5%. Radio spend increased by 1.6%. Cinema records -12.3%. Internet (desktop) showed a decline of 5.4% (Nielsen Media Research).

Forecast 2018-2020

According to Zenith’s September forecast, the German advertising market would experience a stable development in 2018. Nevertheless, they adjusted their growth forecast from June (+2.5%) downwards to 2%, due to the unexpected weak performance of the advertising medium TV. As they expect TV to recover, they are sticking to their growth forecast for 2019 and 2020 (resp. +2.2%). Growth driver continues to be internet (2018: +8.2%; 2019: +7%).

Dentsu Aegis Network in their latest forecast maintain their growth outlook of January unchanged expecting the slight upward trend from 2017 (+2.3%) to continue with an increase of ad spend by 2.6% in 2018. Digital media would be the number one with a market share of 36.9%.

Magna Global predict in their most recent forecast German advertising revenues to grow by 2.5% this year.

Regarding digital advertising (online and mobile) in Germany, the association of online marketers OVK adjusted their original projections for net investments downwards from +10% to +7% (total 2.06 billion Euros) in their autumn forecast – as a result of the uncertainty on the advertising market due to the newly enacted GDPR in May. Nevertheless, digital advertising is on the rise. Major growth drivers would be mobile as well as programmatic and data-orientated advertising.